✨Umoja Protocol Overview

The world's first 'smart money' protocol.

Overview

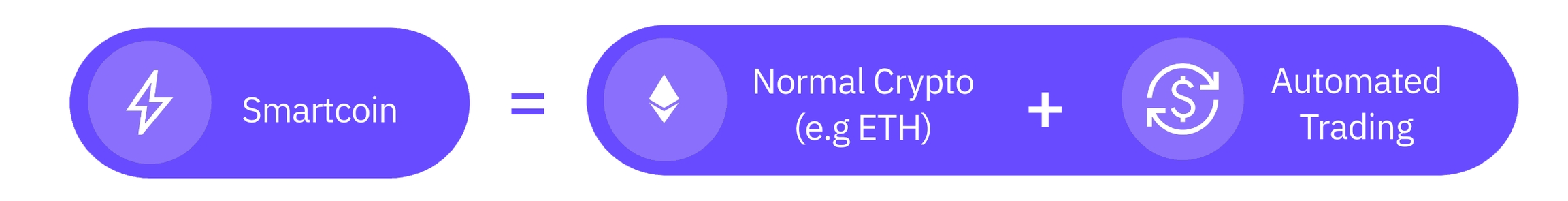

Umoja is an asset management protocol that offers low-risk, high-yield digital assets. It uses something called "Synths" to tokenize asset management strategies. These Synths help automate financial strategies for users and create new competitive assets called smartcoins.

Smartcoins, unlike memecoins, are tied to stable, high-value digital assets and are designed to respond to market changes. They use strategic asset management to minimize risk and boost yields.

For example, consider the 'boosted stETH' or bstETH, which combines an ETH call-option with stETH in a single ERC-20 smart contract. This strategy reinvests stETH's yields back into the ETH call-option during a bull market, aiming to increase returns while keeping liquidity the same.

Umoja may create a near infinite range of innovative financial products to simplify retail asset management into maintaining a token portfolio.

Umoja's goal is to make sophisticated asset management easy and accessible, transforming how people create wealth by allowing anyone to invest in these advanced strategies simply by buying a token.

Website: https://umoja.xyz/

Telegram: https://t.me/umojaprotocol

Twitter: https://twitter.com/UmojaProtocol

Quick links

Launch Features

On V1 release, users will be able to:

Synth Composability. Tokenized Synths can be composed to create new or upgrade existing digital assets via the protocol's API.

Zero Liquidation Synths. Ability to create Synths (i.e., replicated short and long positions) for BTC, ETH, and a variety of other cryptos– without the fear of liquidation, but way more affordable, flexible, and simple than any traditional crypto Option.

20x Leverage. All V1 Synths will have 20x leverage embedded within their trading strategies and require 1/10th collateral of the notional position.

Staking. Users will be able to stake USDC to the Insurance Pool to help the protocol minimize risk and stake $UMJA, the protocol's governance protocol, to the Governance Pool for an APY.

Last updated